Upstart (UPST) is one of the strongest stocks in the market right now, up about 14% this week as it hit a new high Recently!

Upstart stocks are solid, with a composite score of 99 and a potent ratio of 99. Its EPS figure of 65 is low for a growth stock and is primarily explained by lackluster performance over the past eight quarters. The consumer lender was added to IBD’s rating on Thursday. By correcting the market, it is riskier to bet on equity, even if they show the ability to speak well.

One way to get long positions in Upstart stocks while risking less money is to use options. Today, we’re going to look at a dramatic moment, like Tesla (TSLA) last month. This business did well, so hopefully, this one will be the same. A calendar spread is a transaction

that involves selling short options and buying extended options with the same strike price.

Upstart (UPST): Organizes calendar breakdowns for launch events

Traders with a price target of 380 can place a bullish calendar spread at this price. The sale of 380 calls ends on Oct. 29 and will generate about $760 in positions and buy Nov. On the 19th, a 380-critical call will cost about $2,110.

This translates to a net cost per trade of $1,350 per spread, the maximum trade that can be lost. The estimated worth is about $1,550, but this can vary from exchange to exchange.

The logic in the trade is that if the UPST stock trades up to around 380, the calendar gap will increase, resulting in a net profit. Bullish calendar spreads are a great way to get a head start on stocks without taking too much risk if the move doesn’t happen.

A change in meaning can affect money.

The best situation is to climb 380 around October 1st. 29 with little change (or rise) in the mean difference.

The combined position has a net delta of 13, which means that the trade is equivalent to receiving 13 UPST shares, although this will change as the occupation continues. For a business like this, I would set a profit target of 30% and a stop loss of 20%.

Remember that the option is risky, and investors can lose 100% of their money. This article is for educational purposes only and not a commercial recommendation. Always do your due diligence and consult a financial advisor before making investment decisions.

Upstart (UPST): All You Need and Want for Growth in Stock.

Upstart Holdings, Inc. (NASDAQ: UPST) is a high-growth, profitable financial technology (fintech) company with a stock buyback program, improving fundamentals, and stock prices that have fallen completely. Although Upstart’s product has gotten ahead of itself, it delivers AI services that make sense and adds value to the growing industry for ongoing disruption. His prospects are bright. Upstart is taking all the necessary steps to improve its business, make investors feel better, and should be on track for quarterly solid results to be released next week. I am adding to my post now, as I believe it will be a long-time winner. I won’t spend too much time on that chart, but suffice it to say that Upstart was overvalued when it hit an all-time high of around $400/share in October. Although it was sold due to price compression in the last six months, its core functionality has continued to improve. It went up twice in the 70s and seemed to be forming a base.

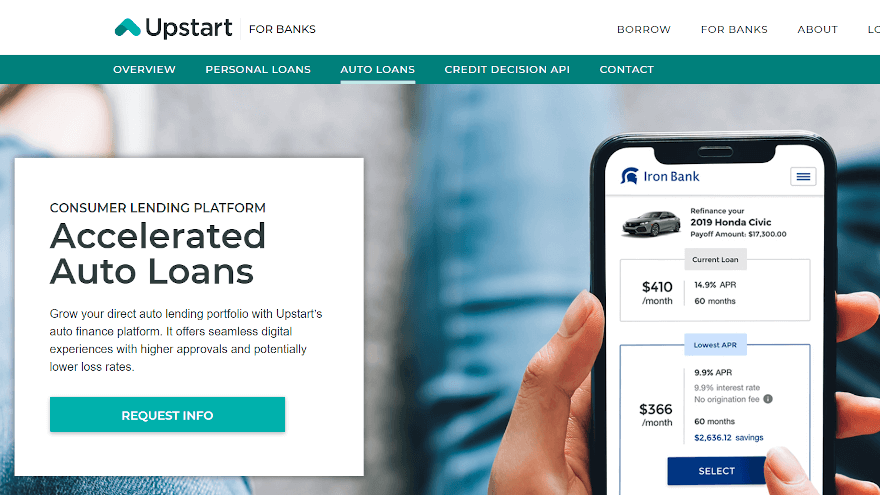

Products

Upstart is an AI lending platform based on a simple concept. Lenders and banks have used the FICO score since the 1950s as a key driver of loan eligibility and interest rates. With the breadth of financial information and data, it is foolish to rely on the same six data points (Usage, Payment History, Account Age, Account Value, Questions, and Derogatory Marks) as one measure. – Any determination of solvency.

Upstart uses thousands of data on each customer to comprehensively view their financial health and determine their suitability.

These records include information about education, cost of living, credit history, and other variables that provide a more complete picture of an applicant than a FICO score can. As Upstart explains on its website, 80% of Americans have never failed, but only 48% have access to credit in the first place. If their AI can close that gap and identify creditworthy people who fall through the FICO cracks but still have to pay back their mortgages which are vast amounts of money, the lending industry will make.

Upstart does not originate loans itself, so it carries no credit risk. They have partner banks that provide loans and bear the risk. Upstart earns referral fees for applicants they approve. This takes the risk off the Upstart’s plate and allows them to focus on their software product without navigating lending regulations or finding capital to finance the loan.

Also, Visit : Is the US facing the rapid High Fly in the Inflation the Economy?

Performance

Unexpectedly, using other data allows AI to identify more suitable people than FICO. If you look at bank acceptance rates compared to Upstart customers at the same acceptance rate, Upstart has 75% fewer defaults. On the other hand, Upstart can support 173% more people going at a given speed.

Upstart worked hard with its partner banks to speed up the process. Most of the time, approval is quick, with no additional documentation required. According to their business document, 99% of loans are approved within one business day of signing up. This is a vast improvement over most loan companies.

Long-term opportunities

UPST is a fast-growing company that is only scraping by on its TAM. They have cut their teeth in the personal loan business and are expanding their auto loan product with plans to get into mortgages and small business loans. Unsecured personal loans represent the highest proportion of risky consumer loans, and the strong performance of this segment has resulted in quick profits for the company. They can use the lessons learned there to win other TAM loan segments that are larger but smaller in size.

What are the risks here?

Algorithm performance in high or low economic conditions

The main risk for Upstart is that they haven’t got where the interest rates are going. Their proof of value lies in the ability of their models to predict default rates better than conventional methods. This motivates banks to use their services because the investment they pay to Upstart helps reduce the risk of default in the loans they provide. The scale-up area will be a stress test of the AI models that Upstart has yet to achieve.

Default rates are likely to increase, especially if there is an economic downturn in the next few years. However, just because the spot rate goes from 1% to 1.5%, or even 2% (a made-up number), does not mean that Upstart’s AI benefits are just because of the country’s current low-interest rate environment acquired.

What is often misunderstood is that the fundamental defect is not significant here; the difference between their defect point and the average defect of other verification methods will determine whether their competitive advantage is strong. If Upstart customers go from a default of 1% to 1.5%, but at the same time, the customer’s FICO score goes from 3% to 4.5%, that’s a win for Upstart. This will ensure that, regardless of the environment, Upstart referrals should pay since they fail less often than other customers.

Decreased demand for personal loans in the economic downturn

Personal loan startups are Upstart’s bread and butter. Although historical data is limited, we show that people tighten their purse strings and carry less debt as the economy slows. The Great Recession of 2007 to 2009 caused personal loans to decline from 2007 to 2011. They did not reach the peak of 2007 to 2015. Similarly, 2020 is a slower year than 2019 due to uncertainty around the disease. A similar trend would likely happen if a recession were to occur in the next few years.

However, any decline in demand for personal loans may be offset by an increase in other types of loans. Although car loans and mortgages tend to decline during times of financial crisis, the volume of this market is so large that it can sustain growth for years to come. One way to overcome the reduced demand risk is accessing other loans, which is precisely what Upstart has planned.

Reasons Upstart is to buy Value.

Unlike many other fintech that has gone public recently, Upstart is already profitable and has seen a steady rise in revenue, revenue, and share since going public in December 2020. . Also, they increase their income at a faster rate.

Although 261% growth from 2020 to 2021 is poor 2020 for personal loans, making unfair comparisons, analysts predict revenue growth of 65% in 2022 and 37 % for 2023, so this growth story still has legs for the next one.

People age Buyback Program

In its 4Q21 financial report, Upstart announced a share buyback program. They have set aside as much as $400 million to buy their stock. As the company buys shares from the public, the stakes are issued to the shareholders in increasing numbers from the lower number of outstanding people.

At a market value of less than $8 billion, $400 million of stock represents 5% of the company. The icing on the cake is a 5% return from pension shares on top of already rising growth and profits.