Early Admonition Administrations, LLC, the organization independent proprietor of Zelle®, today answered misdirecting reports of extortion and tricks on the Zelle Network®.

A huge number of buyers securely use Zelle® consistently with over 99.9% of instalments sent with next to no report of misrepresentation or tricks. Any outside examination done is deficient and doesn’t mirror the endeavours and information detailed by in excess of 1,700 monetary foundations on the Zelle Network®.

Wells Fargo is a forerunner in doing whatever it may take to shield its clients from misrepresentation and tricks. In view of information answered to the Zelle Network®, ongoing proclamations in regards to Wells Fargo’s extortion and trick rates are erroneous. Wells Fargo’s paces of revealed extortion and tricks are uncommonly low and tantamount to the Zelle Network® in general, where paces of announced misrepresentation and tricks address under 0.1% of all exchanges.

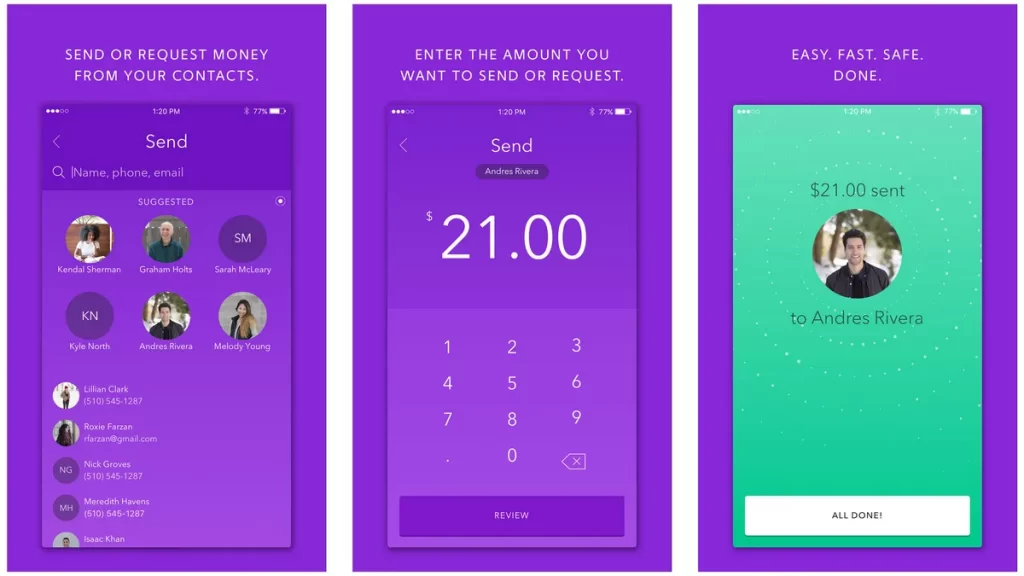

Brought to you by Early Advance notice Administrations, LLC, a pioneer in instalment and chance administration arrangements, Zelle® makes it quick, safe, and simple for cash to move. The Zelle Network® associates monetary organizations of all sizes, empowering buyers and organizations to send quick computerized instalments to individuals and organizations they know and entrust with a financial balance in the U.S. Reserves are accessible straightforwardly in financial balances by and large inside the space of minutes when the beneficiary is selected with Zelle®. To look further into Zelle® and its taking part monetary establishments, visit www.zellepay.com.

About Early Advance notice Administrations, LLC

Early Admonition Administrations, LLC is a fintech organization claimed by seven of the country’s biggest banks. For right around thirty years, our character, confirmation, and instalment arrangements have been engaging monetary establishments to go with sure choices, empower instalments and moderate misrepresentation. Today, Early Admonition is most popular as the independent proprietor of the Zelle Network®, a monetary administrations network zeroed in on changing instalment encounters.

The mix of Early Advance notice’s gamble and instalment arrangements empowers the monetary administrations industry to move cash quick, safe, and simple, so that individuals can carry on with their best monetary lives. To more deeply study Early Admonition, visit www.earlywarning.com

For a considerable length of time, Scottsdale-based Early Admonition Administrations (EWS) has been engaging banks and credit associations to empower instalments and moderate extortion. The organization as of late declared in excess of five billion exchanges and almost $1.5 trillion got across the Zelle Network® starting around 2017. Today, in excess of 1,700 banks and credit associations offer Zelle® in their applications.

EWS is inviting ability across various jobs – including computer programming, client assistance, item, information investigation, showcasing, innovation, and that’s just the beginning.

Join our profession fair at our new central command area (5801 N. Pima Rd.) in Scottsdale. At the occasion, work searchers will hear from organization pioneers, network with employing directors and spotters and apply nearby.

EWS gives cutthroat advantages like 401K coordinating, 12 weeks of paid family leave and limitless PTO for salaried representatives.

Essentially all open positions are accessible for half breed and adaptable working plans. Work searchers can audit the open doors at EarlyWarning.com/vocations.

RSVP – let us in on your wanting to go to by visiting the profession fair occasion page. Intrigued candidates can likewise associate with enrolment specialists straightforwardly at recruiting@earlywarning.com.

The producer of Zelle saw a spike in use of the continuous instalments administration in 2021, with additional individuals involving it for business instalments.

Early Admonition Administrations, the bank-possessed organization which works Zelle, handled 1.8 billion instalments in 2021, up 49% from 2020, with a worth of $490 billion, up 59% yearly, it detailed Wednesday.

Early Admonition addresses banks’ revenue in bringing a more present-day type of monetary administration to shoppers — its proprietors incorporate Bank of America, Capital One, JPMorgan Pursue, U.S. Bank and Wells Fargo.

Following quite a while of endeavours, Zelle is important for a bigger development of ongoing instalments in the U.S. The Clearing House’s RTP network sent off in 2017, and did 37.8 million exchanges esteemed at $15.7 billion in the final quarter of 2021. It’s available to all governmentally protected U.S. store firms. (Zelle involves RTP for a portion of its exchanges.) And the Central bank is pointing in 2023 to send off Fed Now, its own ongoing instalments administration, for which it recently uncovered valuing and credit limits.

The sluggish in the event that consistent advancement comes as different nations have jumped a long way in front of the U.S. progressively instalments: India, China and South Korea are prominent models.

If the U.S. will make up for lost time, the Zelle administration might assume a major part. It’s currently universal in the banking applications and sites that buyers utilize consistently — near 10,000 monetary establishments (up 3,000 from a year prior) presently use Zelle either through a banking application or by utilizing their charge cards with the Zelle application. Most purchasers use Zelle on cell phones, said Al Ko, President of Early Advance notice.

The Zelle application is a way for purchasers to send Zelle instalments on the off chance that their bank doesn’t yet have a Zelle mix. In any case, Early Admonition isn’t taking a gander at its application to contend with different instalments applications. It’s more planned as a placeholder until banks are associated with Zelle, Ko said. After a bank adds Zelle, buyers are approached to change to their bank’s application. That is a vital distinction among Zelle and fintech applications like PayPal, Venmo or Block’s Money Application.

While “by far most” of Zelle’s instalments are shared, there’s a rising utilization of the assistance for organizations, Ko said. The typical exchange size in the final quarter of 2021 was $272, which shows more use for paying private companies, he said.

“Banks are excited by it, since it’s only commitment with their application that is simply ordinary valuable, and individuals favour that it’s attached to the financial records, and afterward individuals favour it since it’s an application they as of now use,” Ko said.

Zelle is likewise dealing with a QR code highlight that permits individuals to pay organizations, which is being utilized now on a restricted premise yet isn’t carried out totally. That would mean shoppers wouldn’t need to request a business’s email address or telephone number to pay.

Zelle’s exchanges move in three ways. They’re basically done by means of ACH, yet more are progressively traveling through RTP. On the off chance that a client selects to interface their charge card through the Zelle application, it will move over the Visa rails; that is a somewhat modest number of exchanges. Yet, paying little mind to how it moves, for buyers, the exchange occurs in a flash, regardless of whether it takes more time for banks to settle, Ko said.