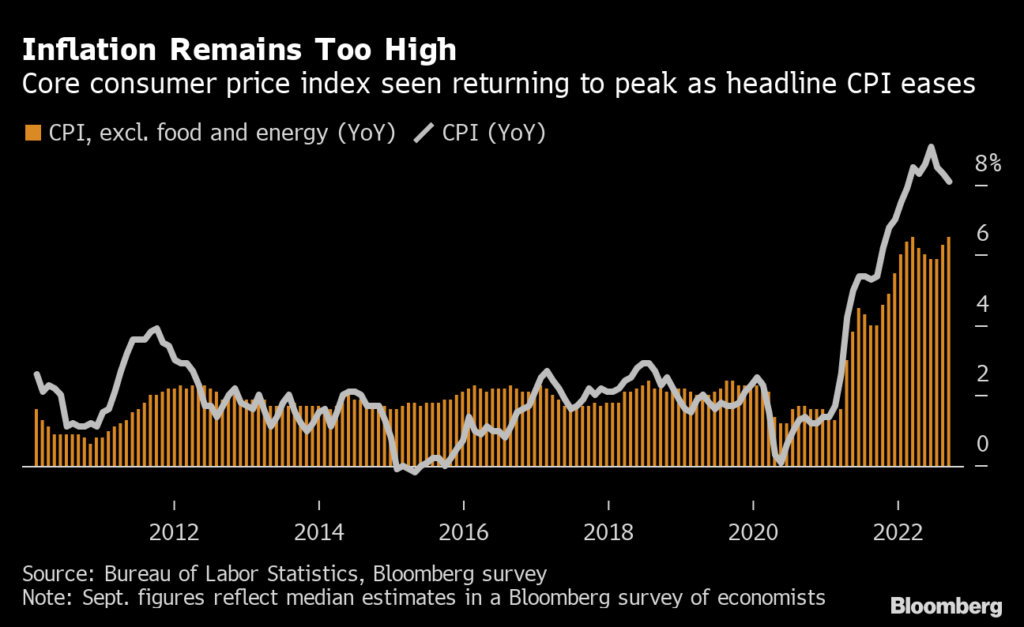

As prices continue to rise, consumer prices in the United States, excluding energy and food, hit a four-year high in September, a sign that inflation is continuing to make the economy strong.

The so-called core consumer price index, which excludes energy and food costs, rose 6.6% from a year earlier in September, the Department of Labor said, compared to 6.3% in August. After an increase of 8.3% in August, the total CPI increased by 8.2% in September compared to the previous month. However, the cost of housing, health care, food, and other things has continued to rise, raising the risk of high rates in the long run.

At the end of September, Jerome Powell, chairman of the Fed, announced that the institution would keep interest rates high and continue to raise them until it is clear that there is an inflation rate. September became the first month without an increase since May 2020 in the producer price index for basic goods. Adjusted for inflation and seasonality, gross domestic product, the total amount of money consumers spend on goods and services, fell at an annual rate of 1.1% in the first half of the year.

As predicted in September, almost everyone in the Fed plans to raise their benchmark interest rates by 4% to 4.5% by the end of this year. Fast-rising consumer prices in the United States showed no sign of slowing in September, fueling a tough trading session on Wall Street as investors debated whether the Federal Reserve should tighten more power to stop the price run. The core index of consumer prices, which excludes energy and food prices, rose 6.6% on a year-on-month basis last month, faster than the 6.3% rate in August and its fastest pace in forty years.

Glimpse about the inflation Last Month

Last month’s CPI increase, including energy and food, was 8.2% higher than a year ago, a slight change from the year-on-year increase of 8.3% recorded in August. Compared to the previous month, the headline CPI rose 0.4%, while the core index rose 0.6%. The S & P 500 fell 2.4% shortly after the opening bell on Wall Street on Thursday; before the opening of the market, the futures market showed a gain of 1.3%. However, the shares took a sharp turn and closed up 2.6%.

The Nasdaq Composite fell 2.2%, recovering from a decline of about 3.2%. The yield on the two-year bond, which is sensitive to changes in monetary policy expectations, jumped 0.24 percent to 4.53 percent, its highest level since mid-2007, before retreating to 0.18 percent on the day.

Jamie Dimon, CEO of JPMorgan Chase, said that while he cannot predict whether tighter monetary policy will push the US economy into a deep recession, the collapse of the high-end stock market is an indication that investors still believe in a “soft recession. “. is possible. “What I’m saying is, with a strong recession, you would expect the market to go down another 20 or 30 percent or more,” Dimon said Thursday at the annual meeting of the members of the Institute of International Finance.

Dimon said consumer spending is still higher than before the Covid-19 pandemic, adding that consumers “can do this for another nine months before inflation and spending catch up with them. That’s why I think you’re going to see a strong economy for a while. Investors and economists are looking for signs that the Fed may begin to increase the pace of interest rate increases from the 0.75 percent increase it has announced each week to do the previous three meetings.

But CPI data released on Thursday suggests that such a move has not been immediate. Following the news, traders in the futures market placed a 98% chance of the Fed raising interest rates by 0.75 percent in November, up from 84% on Wednesday. Kathy Bostjancic, the chief US economist at Oxford Economics, said consumer prices remained “significantly high” due to “continued and widespread increases” in prices in major service markets.

Futures markets expect the federal funds rate to hit 4.94% by May 2023, up from 4.65% the previous day. The central bank’s policy rate is within the target range of 3% to 3.25%. One of the most troubling aspects of the CPI report is that rents – defined as “houses” in the data – rose 0.7% in September, as they had the previous month, and increased by 6.6% per age. . Continued high inflation has become a major political challenge for the White House and congressional Democrats, overshadowing the rapid recovery from the pandemic and the millions of jobs created since Joe Biden became president.

Down In a statement Thursday, Biden acknowledged that the cost of living is affecting Americans and said there is “more work” to be done to address costs even though “progress” has been made. He said that if Republicans control Congress in November’s midterm elections, “the daily income will go up, not down.” Republicans have made the rate hike a key part of their message to voters, blaming the Biden administration for linking the hike to the stimulus package signed by the president in March 2021 that brought in $1.9 billion and the US economy.

Current Changes in Inflations!

On Wednesday, several Republican senators and candidates jumped on new numbers showing the Producer Price Index, a measure of business prices for businesses, rose faster than expected in September. Rick Scott, a Republican senator from Florida who is chairman of the Senate Republican National Committee, said the increase was “an unbearable strain on families trying to get back on their feet” in his state following Hurricane Ian.

US consumers are relieved by the fall in fuel prices in the summer: the peak in inflation under Biden came in June, when the CPI rose 9.1% annually. But the administration and Fed chiefs would love to see rates rise faster than they did.

The main rate increase for August 2022 is 6.3% per year. This means that the price of everything except food and energy has increased by 5.9% since August 2021.

The August rate was higher than economists had expected. The base price excludes food and energy costs because the price of these items varies from month to month and can be affected by the high rate of inflation. This deduction makes the head count better than the headcount rate for measuring the underlying growth rate.

This is precisely why central banks prefer to use the underlying inflation rate when setting monetary policy.

Core inflation

It increased by 0.6% in August 2022, after rising to 0.3% in July. New cars, housing, and healthcare services were key contributors to the higher-than-expected rise in core inflation in August.

What is Core Inflation?

The core inflation rate is the change in the price of goods and services, including food and energy. Food and energy products are not too variable to include. They change so quickly that they can distort the correct reading of the underlying growth process.

- Other names include the Consumer price index for all urban consumers with less food and energy and the personal budget index excluding food and energy.

- Acronyms: CPI excludes food and energy, PCE excludes food and energy

Why do food and energy prices fluctuate?

Food and energy prices are volatile because they are traded in commodity markets. Most food (such as wheat, pork, and beef) and energy (oil, gas, and gas) trade throughout the day.

For example, commodity traders raise the price of oil if they think it will fall or demand will rise. They may think that war will make the oil run out. They will buy oil at today’s price to sell it at a higher price tomorrow. This is enough to raise the price of oil. If war does not happen, the price of oil falls, and it is sold. The cost of food increases with the cost of fuel because food is transported by interstate trucks. It consumes a lot of gas. When the price of gasoline rises and rises, you will eventually see the effect on the price of food in a few weeks.

So overlooking these entire factors, it is pretty clear about the rapid high fly in the inflation of the US Economy! Read other blogs